“When Switzerland put its mind to it, anything is possible”

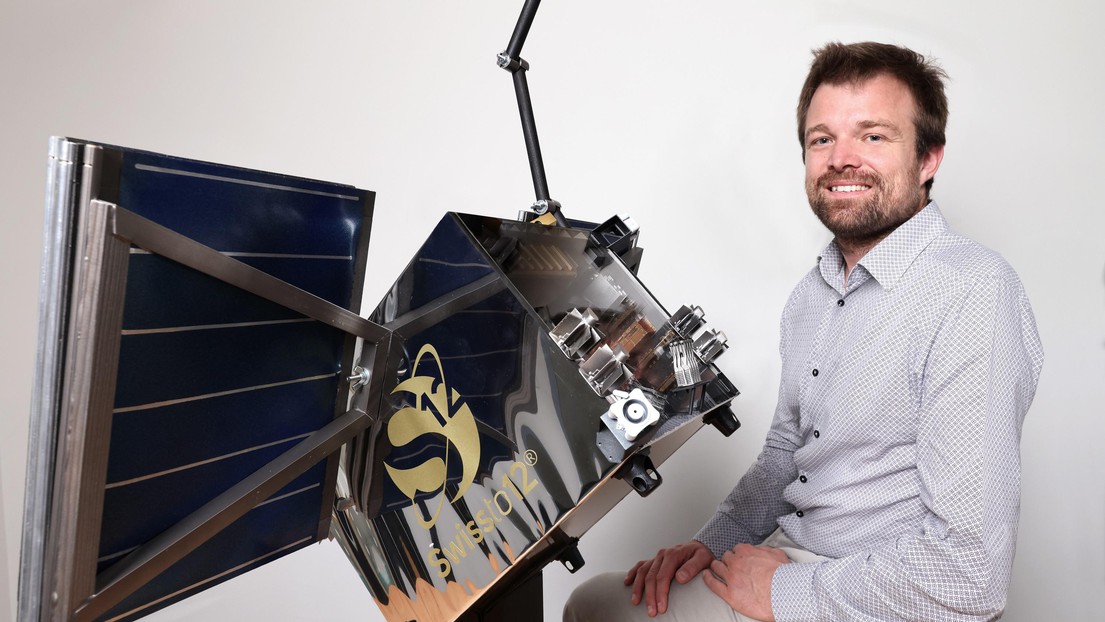

Emile de Rijk, CEO de SWISSto12 © Alain Herzog, EPFL

EPFL spin-off SWISSto12 has just signed a deal to supply a satellite to telecommunications service provider Intelsat. Here, we discuss this success story with CEO Emile de Rijk, who also shares his thoughts on what lies ahead for the Vaud-based company.

EPFL spin-off SWISSto12 has just signed a deal with satellite telecommunications service provider Intelsat. The company, founded in 2011 and located in Renens, will develop, manufacture and supply a groundbreaking telecommunications satellite less than one-third the size and weight of conventional models. In this interview for EPFL’s Technology Transfer Office, CEO Emile de Rijk reflects on this major milestone for SWISSto12 and discusses what lies ahead for the firm.

What does this deal with Intelsat mean for SWISSto12?

This deal marks the first time that a global telecommunications operator has ordered an operational Geostationary telecommunications satellite from a company other than one of the big aerospace firms. That hasn’t happened since the industry came into being around 60 years ago. It’s also a milestone for our company because we’re launching a new product line, namely our own (complete) satellites. Up until now, we’ve focused on 3D-printed antenna components for telecommunications satellites, and for telecommunications, surveillance and radar systems for the aerospace industry.

What convinced you to develop your “own” satellite?

Thanks to our initial technology, conventional aluminum antennas (with components manufactured separately and then assembled) can be replaced with one-piece 3D-printed models that are as much as 90% lighter, optimized for better performance and faster to produce. Around three years ago, we thought that if we could optimize satellites in this way, it might be worth exploring the market and seeing whether we could develop our own satellite using our unique, patented technology.

What’s different about this new product?

Our satellite, known as HummingSat, is between one-fifth and one-third the size and weight of conventional models, which means it’s also less expensive. It’s about the same size as a washing machine, whereas existing satellites are equivalent in size to a tractor trailer.

On average, conventional satellites cost somewhere between $150 million and $500 million. That kind of money represents a significant outlay for operators, which they can only recoup by making sure they have customers throughout the satellite’s lifespan – typically in excess of 15 years. Consequently, operators tend to steer clear of many markets because they’re too small or because the uncertainty is too great. But the demand is still out there, with unserved (or underserved) customers that are ready and willing to pay.

That’s where our new product comes in – a smaller and much cheaper satellite that gives telecommunications operators more flexibility in their investment decision-making. For instance, they can now test a new market with a small satellite and, if it pays off, switch to a bigger model down the line. HummingSat could also cater to smaller countries that want to build their own, secure, independent telecommunications network, but for which investing in a large satellite doesn’t make sense because it would be too expensive, or because their territory is too small to optimize its use.

Do you have any competitors?

Some firms in the Europe and United States are also developing smaller telecommunication satellites, but we’re the first company of our kind to sign a deal with a major, established and global satellite operator. We are positioning ourselves in a brand-new market segment, in this class of satellite size and capacity class.

How do you see the future playing out for SWISSto12 in the coming years?

A lot of customers have expressed an interest in our new product. We’re hoping to sell more satellites each year and grow this side of our business. Because these are major projects, with contracts worth tens of millions of dollars, we are continuously expanding our team and welcoming talented individuals interested in shaping a new chapter of the industry. We currently have over 50 employees, and we’re looking to add around 30 new hires in 2023.

What’s your view of the space technology landscape in Switzerland?

The Swiss have a reputation for being unassuming. But when Switzerland puts its mind to it, anything is possible. Swiss firms tend to focus on niche technologies and highly specific products. But, as we’ve shown, there’s nothing stopping us from developing competitive turnkey systems – this is worth emphasizing. Astrocast and ClearSpace are other examples of recent success stories around Lausanne.

We also enjoy strong backing from the European Space Agency (ESA) and the Swiss Space Office (SSO). For instance, we’re building this new satellite for Intelsat in partnership with ESA, which is co-funding some of the development work and providing us with an extensive technical team and key expertise needed to complete the work. This partnership has been instrumental in helping us take our business to the next level.