The Economics of Over-the-Counter Markets

© 2025 EPFL

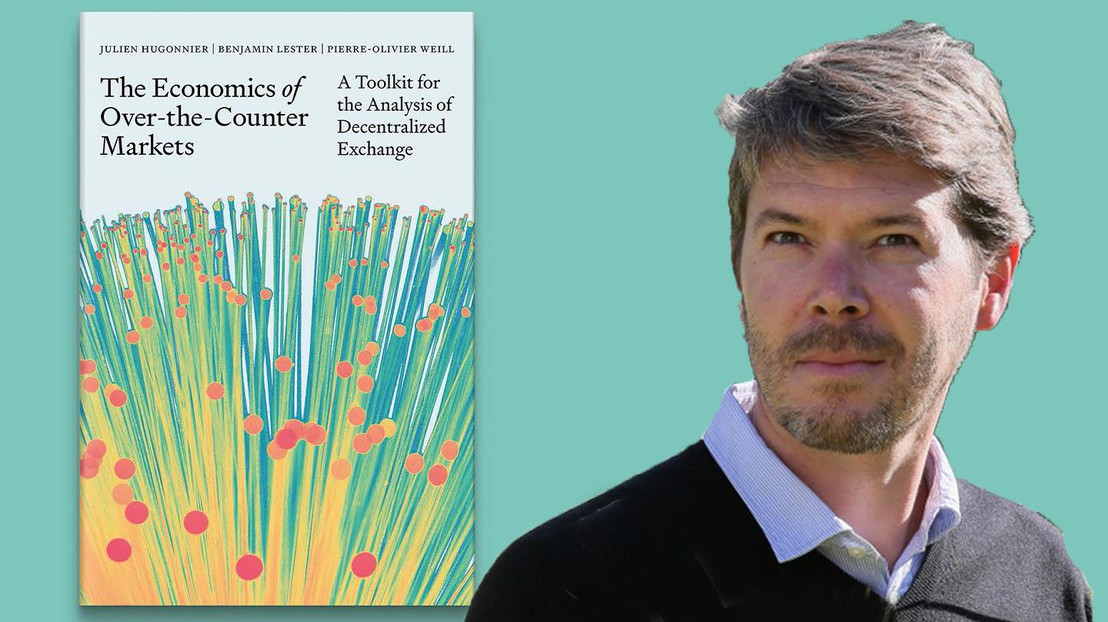

Prof. Julien Hugonnier has published a new book at Princeton University Press entitled "The Economics of Over-the-Counter Markets: A Toolkit for the Analysis of Decentralized Exchange". It is a comprehensive book that delves into the intricate workings of over-the-counter (OTC) markets, which are prevalent in the trading of corporate and government bonds, as well as many financial derivatives. Authored by leading researchers, the book offers a unified theoretical framework that examines the economic mechanisms driving these markets. It provides valuable insights and analytical tools for regulators, market participants, graduate students, and researchers to better understand and navigate the complexities of decentralized exchanges.

Abstract

Many of the largest financial markets in the world do not organize trade through an exchange but rather operate within a decentralized or over-the-counter (OTC) structure. Understanding how these markets work has become increasingly important in recent years, as illiquidity in certain OTC markets has appeared as the first signs of trouble—if not the cause itself—of the past two financial crises. However, standard models of financial markets are not suitable for studying the causes of illiquidity in OTC markets, nor the optimal policy response. The Economics of Over-the-Counter Markets proposes a unified search-theoretic framework designed to explicitly capture the key features of OTC markets, confront the growing set of stylized facts from these markets, and provide guidance for policies designed to promote liquidity and resiliency. This incisive book covers empirical regularities that are common across OTC markets, develops the methodological tools to analyze the benchmark theoretical models in the academic literature, and extends these models to confront the latest issues facing these markets.

Book presentation