Swiss airline ticket tax: what impact on the environment?

© EPFL & Université de Lausanne

The Enterprise for SocietyCenter (E4S) published its first Policy Brief on the introduction of an airline ticket tax in Switzerland. The results of the study show it could cut Switzerland's total global warming impact by up to 2%

Abstract

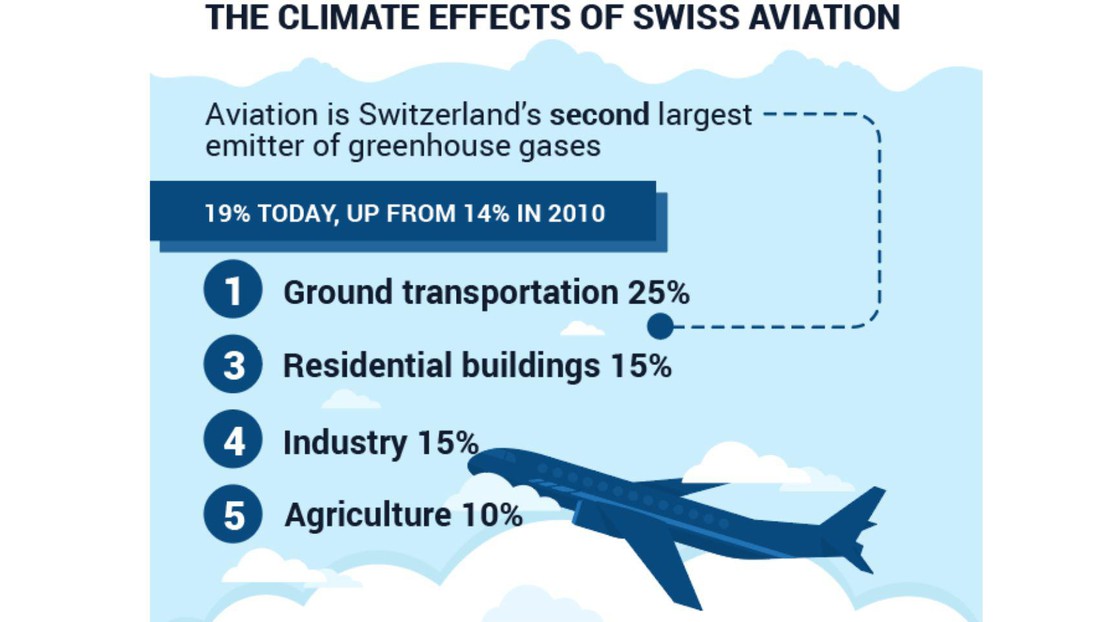

Air travel accounts for a large and rapidly rising share of Switzerland’s global warming impact: some 19% today, up from 14% in 2010. Technology is not improving fast enough to offset booming demand for flying. The Swiss parliament is therefore considering the introduction of an airline ticket tax. We provide first-pass estimates of the impact of such a tax on demand for air travel and on emissions. The tax currently considered –30 to 120 CHF per airline ticket –would significantly curb demand. It couldreduce air traffic by up to 20%and associated greenhouse emissions by up to 12%. This would cut Switzerland’s total global warming impact by up to 2%. At the rate at which kerosene sales have been rising over thelast decade, these emissions savings would be offset by growth in the demand within three years. Since long-haul flights account for an estimated 79% of emissions with only 22% of passenger volume, the mitigating impact on emissions could be strengthened through a more progressive rate schedule, featuring top rates above the ceiling of 120 CHF and low rates below 30 CHF. Interestingly, such an improved emissions outcome could be attained with a smaller drop in passenger numbers compared to our interpretation of Parliament’s baseline scenario. Any ticket tax will have a stronger impact if indirect flights via European hubs are not taxed as short haul but as long haul and if transfer flights are included. We do not simulate distributional impacts of the airline ticket tax but note that the tax foreseen by Parliament would generate revenues of up to 1 bn CHF per year.