Record Cashflow for EPFL Spin-offs, Many of Which from IC

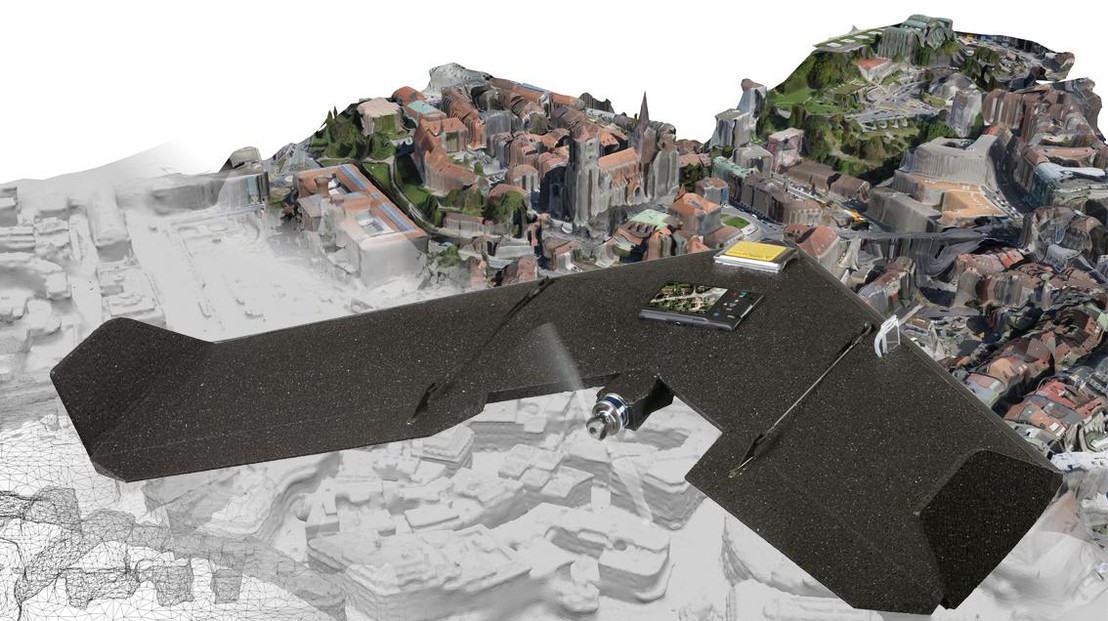

SenseFly (drones) and Pix4D (3D images), two of the start-ups which generated cash flow © Alain Herzog

In 2012 ten EPFL spin-offs shared close to 100 million francs from private investors. This is a record, even apart from Biocartis, which alone generated almost half of the money. Investments in the other companies doubled compared to 2011.

The EPFL spin-offs generated considerable cash flow over the last year: 98 million francs. The ten companies sharing the financial windfall were founded on EPFL technology.

Twice the amount raised in 2011

Even apart from Biocartis, which alone raised half of the funds, 2012 is a record year. Nine other spin-offs shared 56 million, almost double the amounts of 2010 and 2011, when they raised a total of 22 million.

Six of these start-ups specialize in medtech, one in robotics, and three in Information Technology (IT). While the medical field has always raised quite a bit of money, particularly because of the infrastructure already in place, the number of IT companies that generate such investments has increased. “There is a definite correlation between seed money injected by the MICS spin fund over the last years and the number of successful start-ups” says Hervé Lebret, head of EPFL’s Innogrants (seed funding for start-up entrepreneurs).

This is the first round of fundraising for several of these companies such as Abionic, Sensefly, Pix4D (IC), Bicycle Therapeutics, and KB Medical. Whereas others, such as Sensimed, Typesafe (IC), Nexthink (IC), and Aleva, previously raised money.

It remains difficult to compare this performance on the European level, as there exists no source that synthesizes data on academic spin-offs. But according to Hervé Lebret, EPFL is among the best in terms of technology transfer, along with Cambridge and Oxford in England, and the University of Leuven in Belgium.

What is the source of this financing that seems unaware of the financial crisis? The United States, Europe, and Switzerland contributed in equal parts. The vast majority (80%) comes from venture capital, and the rest (20%) from Business Angels. The considerable stability of Switzerland and the growing reputation of EPFL surely play an important role. “Plus, the cycles of venture capitalism and private flows have a rhythm that doesn’t correspond to the global economic situation,” explains Lebret.

Although the financial returns do not directly benefit EPFL and the selling of companies is rare, these climbing companies do represent a real benefit to the region. They create jobs, stimulate competition among future entrepreneurs, and catch the interest of other investors. Will 2013 be as generous? “This remains to be seen,” says Hervé Lebret, “given that 98 million francs marks an annual record that is, by definition, exceptional.”

Further information on the start-ups of the School of Computer and Communication Sciences: http://ic.epfl.ch/tech-transfer_en