Company boom-and-bust is governed by physics

Thinkstock | © Alberto Hernando/EPFL

Scientists at EPFL solve a hundred-year-old problem: why the size-distribution of firms is governed by power laws.

Every business venture carries a risk of failure, but it is difficult to predict if a company will grow or fail. Companies can fail or thrive in favorable or adverse economic environments respectively; on a large enough scale, boom-and-bust seems almost as random and unpredictable as coin toss. EPFL scientists have now discovered patterns in the whirlwind, showing that it is governed by the laws of physics – specifically entropy. The work is published in the Journal of the Royal Society Interface.

Companies are essentially groups of people who work together and take arbitrary or rational or tradition-based decisions on a daily basis. However, just like cities, it is possible to find patterns in that apparent chaos.

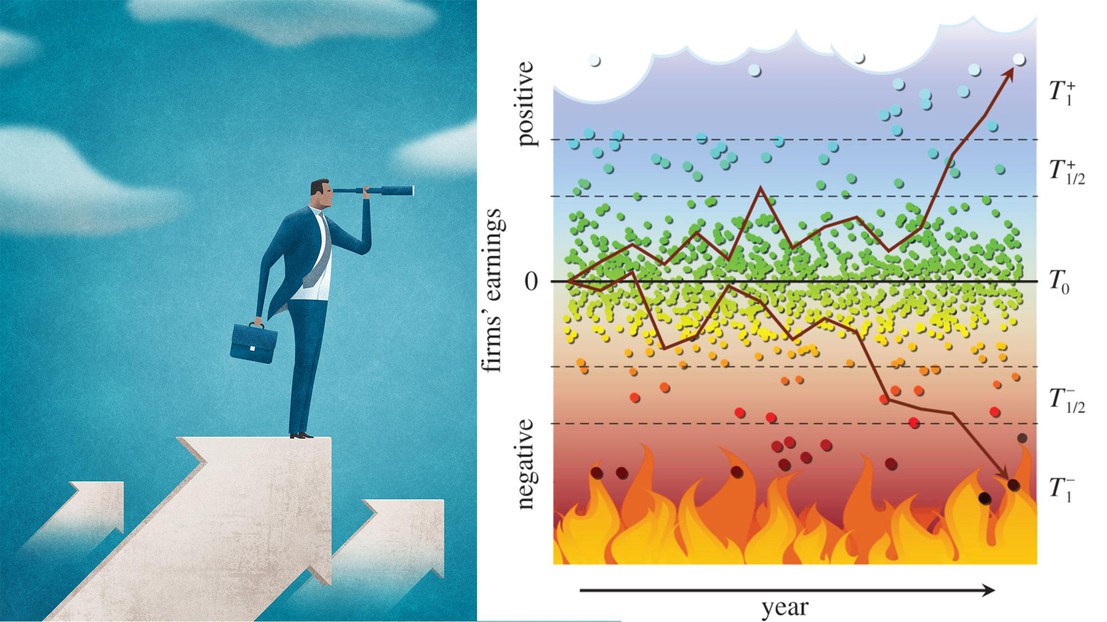

A team of scientists from the lab of Jiri Vanicek at EPFL and the EPFL startup company SThAR has used an equation that relates the exponent of empirically observed power laws with the fate of the companies. The key to this was the discovery that the dynamics of company boom-and-bust matches a well-known thermodynamic quantity: the chemical potential.

The chemical potential describes the energetic “cost” that a system must “pay” in order to include or exclude particles. At any given time, the system favors either the inclusion of particles or destruction of particles. This process is described by the laws of entropy.

The researchers used these principles to simulate the fate of companies. This approach is not new; the same team has previously used to predict the growth of cities, and successfully applied it in Spain.

Here, the scientists check the size-distribution of companies in a given region. To do this, they used an indicator of financial performance known as the EBITDA: “Earnings Before Interest, Taxes, Depreciation and Amortization”.

The EBITDA data showed a pattern: The indicator systematically follows the math of the maximum entropy principle in a physical system. Indeed, any group of firms evolves by interaction among its members, purely rational economic policies, corporate decisions, and international strategies – but also under pure randomness, improvisation and panic. In other words, companies follow the mathematical principles of entropy.

It was already known that the failure of companies is independent of their age or size. “Because it's entropic, we can formulate full thermodynamic equations of state around any company – and do so with significant predictive power,” says Alberto Hernando, one of the study’s researchers.

The equations can also construct a simulator of a company’s economic system and test policies before executing them in the real world. This is, in fact, next on the team’s research agenda. “This information is critical in deciding whether or not a particular economic environment supports the creation of new companies,” says Hernando. “We now have a scientific way to ask the question.”

This study involves a collaboration of EPFL with Social Thermodynamics Applied Research (SThAR), Universitat Rovira i Virgili (Spain), and the National University of La Plata (Spain).

Reference

Zambrano E, Hernando A, Fernández Bariviera A, Hernando R, Plastiáno A. Thermodynamics of firms’ growth.J. R. Soc. Interface 12: 20150789, 28 October 2015. DOI: 10.1098/rsif.2015.0789