New publication by Prof. Ralf Seifert on the Bullwhip Effect

© Wikipedia

The article entitled "Quantifying the Bullwhip Effect using Two-Echelon Data: A Cross-Industry Empirical Investigation" has been accepted for publication in the International Journal of Production Economics.

Abstract

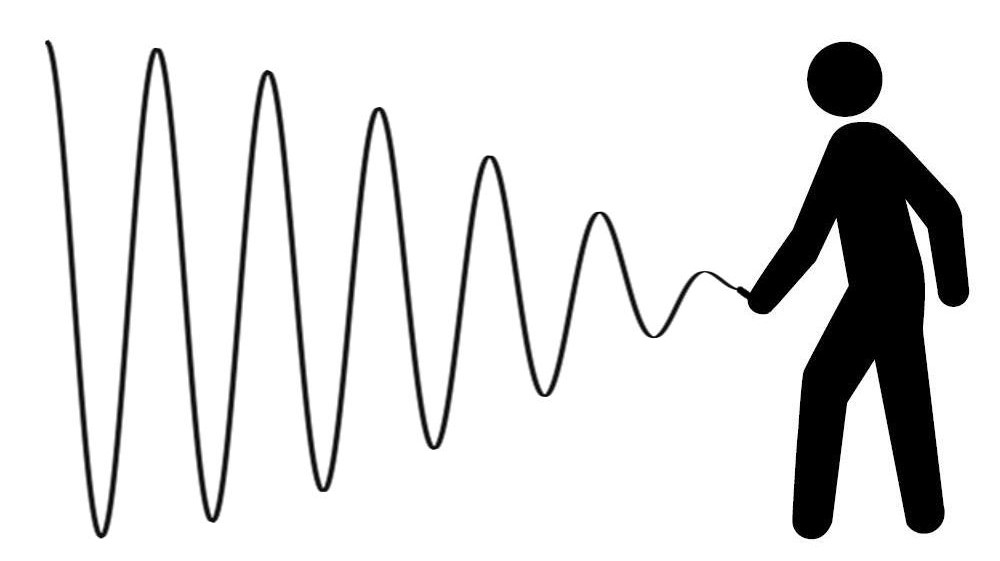

The bullwhip effect denotes the phenomenon whereby demand variability is amplified from a downstream site (buyer) to an upstream site (supplier) in the supply chain. This paper contributes to the literature that empirically investigates the bullwhip effect by providing new evidence regarding its prevalence and magnitude. In contrast to previous work, we use a two-echelon approach, which allows us to observe variations at both the upstream and the downstream sites. By drawing on a financial accounting standard regarding information disclosure about major customers, we are able to link 5,494 buyers and suppliers in the U.S. between 1976 and 2009. We merge this information with quarterly financial accounting data to form a sample of 14,933 buyer-supplier dyad observations. We correct for sample selection bias using propensity score matching and estimate the average bullwhip effect in our sample to be 1.90 (i.e. 90\% demand variability amplification between echelons). A significant bullwhip effect is observed across industries (mining, manufacturing, wholesale and retail) and is supported by several robustness checks. We investigate and discuss how these results can be generalized beyond our sample.

Reference

Isaksson, O. H. D. and R. W. Seifert (2015) "Quantifying the Bullwhip Effect Using Two-Echelon Data: A Cross-Industry Empirical Investigation," forthcoming in the International Journal of Production Economics.